To claim insurance with Otosigna, you need to first document the incident that happened, like a car accident or property damage. Then, contact Otosigna quickly and give them all the details about what happened to your Otosigna claim approval.

You’ll have to file a claim and provide any important documents they need, like police reports or repair estimates. Otosigna will check your claim and decide if it’s approved. If there’s any disagreement about the claim, they have a way to solve it.

In this article, we’ll explore the straightforward steps for filing an insurance claim with Otosigna. The focus is on documenting the incident, contacting Otosigna, and the necessary steps for claim approval.

Contents

Important Aspects of Otosigna Claim Approval

The first step in navigating the claim approval process at Otosigna is to understand your coverage. Your auto insurance policy may include liability insurance, collision coverage, and comprehensive insurance, each covering different types of damages. Knowing the extent of your coverage and your policy limits will guide you in what damages you can claim.

The claim submission process is another crucial aspect to understand. This typically involves reporting the accident, providing necessary documentation such as the vehicle accident report, and cooperating with the insurance adjuster during the claim review and investigation process.

Mistakes to Avoid in Claim Filing

In order to successfully navigate the claim approval process at Otosigna, there are certain pitfalls to avoid.

- Delay in Reporting the Accident: It’s crucial to report the accident to your insurer as soon as possible. Delays can complicate the process and may even lead to denial of the claim.

- Insufficient Documentation: Not providing enough evidence of the accident and the damages incurred can hinder the claim process. This includes police reports, photos of the accident scene and damages, and records of expenses related to the accident.

- Misrepresentation of Facts: It’s important to provide accurate information when filing a claim. Any discrepancies can lead to denial of the claim and may even result in legal consequences.

- Ignoring Follow-ups: Stay proactive during the claim process. Respond promptly to any requests for additional information and keep track of all communications with the insurer.

- Settling Too Quickly: While it may be tempting to settle the claim quickly, it’s important to ensure that the settlement amount adequately covers all damages and related expenses. Consult with a legal advisor if needed.

Armed with this knowledge, Allentown drivers can better navigate the claim approval process at Otosigna in 2024, whether they’re seasoned policyholders or new to the insurance process. For more detailed guidance on this process, refer to our comprehensive guide on how to claim auto insurance in Allentown 2024.

Otosigna’s Claim Approval Process

Understanding the claim approval process of your auto insurance provider is crucial for a smooth and efficient claim experience. In this section, we will shed light on the claim approval process of Otosigna, a popular auto insurance provider in Allentown.

Overview of the Process

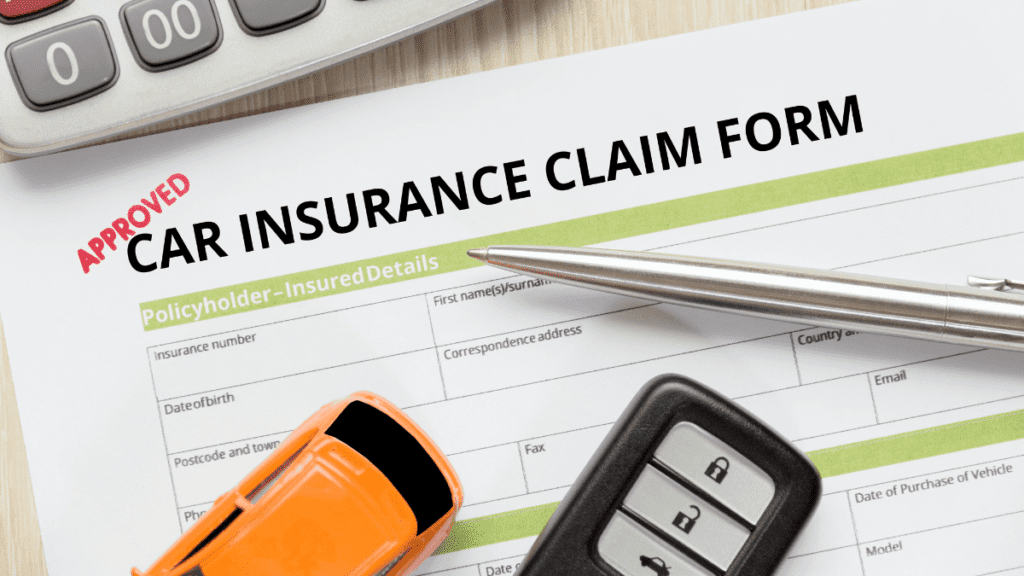

Otosigna Insurance has a streamlined claim approval process that enables customers to complete the process online within minutes (Futurique). This process involves the submission of necessary documents and information, including photos of damage, receipts, and a completed claim form.

Aimed at providing a hassle-free experience for their customers, Otosigna’s claim approval process is designed to be fast and convenient. This allows policyholders to have their claims approved quickly and receive their settlements in a timely manner.

The claim approval process involves the following steps:

- Initiating the claim process through their online portal or mobile app.

- Providing details of the incident and submitting required documentation, such as photos of damage, receipts, and a completed claim form.

- Review and investigation of the claim by Otosigna’s claim adjusters.

- Approval or denial of the claim based on the investigation results.

- Receiving compensation if the claim is approved.

Role of Technology in Claim Approval

The role of technology in Otosigna’s claim approval process cannot be overstated. By offering a simple and efficient online claim approval process, Otosigna aims to simplify the insurance claiming process for their customers.

The company leverages its online portal and mobile app to facilitate the claim process, making it convenient for customers to initiate and track their claims.

The use of digital platforms allows for faster processing of claims, as policyholders can instantly upload necessary documents and information. This eliminates the need for physical paperwork and enables a more streamlined communication process between the policyholder and the insurer.

Moreover, these platforms offer transparency in the claim process, as policyholders can easily track the status of their claims in real-time.

By leveraging technology in their claim approval process, Otosigna ensures a seamless and efficient claim experience for their customers. This reflects the company’s commitment to customer satisfaction and its efforts to stay ahead in the digital age. For more information on Otosigna’s claim approval process, visit.

Pre-Claim Preparation

Before embarking on the claim approval process with Otosigna, it’s crucial to be well-prepared. This involves gathering necessary information and having a clear understanding of your policy limits and deductibles.

Gathering Necessary Information

Before contacting Otosigna to initiate the claim process, gather all pertinent information related to the incident. This includes your personal details, policy information, a police report (if applicable), photographs, and any other relevant documentation (LinkedIn).

Here’s a checklist of the information you might need:

- Personal details: Name, contact information, and policy number.

- Incident details: Date, time, and location of the incident.

- Other parties involved: Their contact information and insurance details, if applicable.

- Police report: A copy of the vehicle accident report if the incident was reported to the police.

- Photographs: Clear pictures of the damage to your vehicle and the accident scene.

- Witnesses: Details of any witnesses to the incident.

Having all these details at your fingertips will streamline the claim submission process and increase the chances of a successful claim.

Understanding Policy Limits and Deductibles

Being aware of your policy’s deductible and coverage limits is an integral part of the pre-claim preparation. The deductible is the amount you must pay before the insurance company provides compensation. Coverage limits, on the other hand, are the maximum amount the insurance company will pay for a claim.

Your policy’s coverage limits will depend on the type of coverage you have. For example, collision coverage will have different limits than liability insurance or comprehensive insurance.

It’s also important to note that filing a claim may impact your premium. Before filing a claim, it’s wise to consider the cost of the deductible, potential increase in premiums, and the amount you could receive from the claim.

Understanding these aspects of your policy will help you make informed decisions during the claim process and avoid any unwelcome surprises. For a more detailed look at how to prepare for a claim, check out our article on car insurance claim in Allentown 2024.

Steps to File a Claim with Otosigna

Navigating the claim approval process with Otosigna can be a seamless experience if you understand the necessary steps and have the right documentation at hand.

Initiating the Claim Process

Before initiating the claim process, gather all pertinent information related to the incident, including personal details, policy information, a police report (if applicable), photographs, and any other relevant documentation (LinkedIn).

Once you have all the necessary information, you can contact Otosigna to start the claim process. Otosigna Insurance in Mineola, TX has an online claim approval process that can be completed within minutes.

To initiate your claim, visit the Otosigna claim submission page. You can also use the Otosigna online claim portal or the mobile app insurance claim feature to file your claim.

Providing Required Documentation

As part of the claim approval process, you will need to submit necessary documents and information, such as photos of damage, receipts, and a completed claim form.

Providing comprehensive documentation can expedite the claim process and increase the chances of approval. This includes any vehicle accident reports, photographs of the accident scene and damages, witness statements, and medical records (if applicable).

If repairs are required, you may also need to provide an auto repair estimate. Otosigna may request a vehicle inspection to validate the damages claimed. Ensure to choose from Allentown approved car repair shops to avoid any disputes during the claim approval process.

Remember, the more detailed and accurate your claim documentation is, the smoother the claim approval process with Otosigna will be.

For more insights into the claim approval process and what to expect after filing a claim, visit our guide on what happens after filing a claim.

What Happens After Filing a Claim?

Once you’ve submitted your claim to Otosigna, there are several steps that take place as part of their claim approval process. It’s important to understand these steps so you can effectively navigate your insurance claim experience.

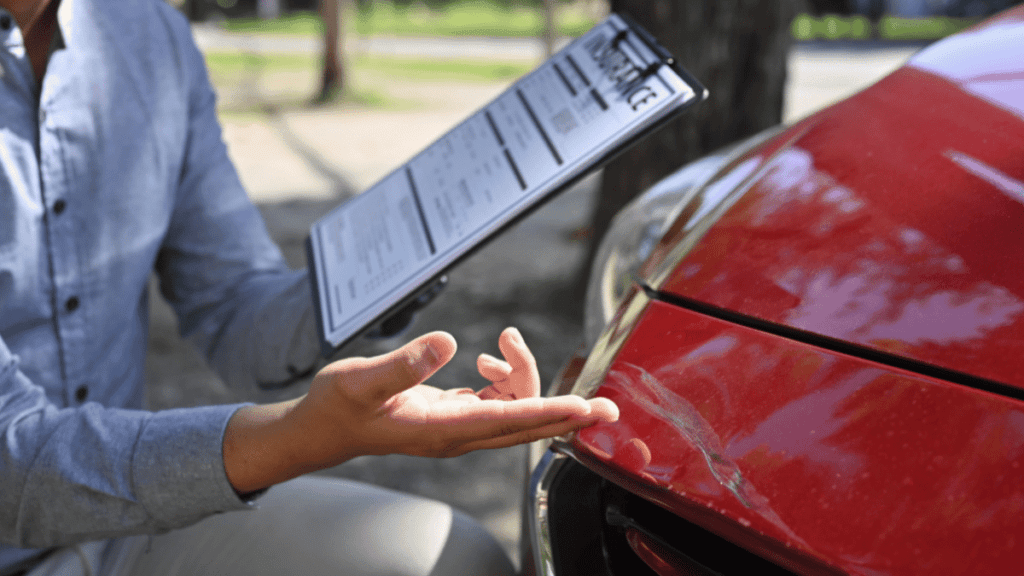

Review and Investigation of Claims

The first step after submitting your claim is the review and investigation phase. During this stage, Otosigna verifies that all required documents have been submitted, ensures that the claimed expenses are within the allowed limits, and determines if any additional documentation or information is needed (Military OneSource). They may also contact you for any necessary clarification or documentation.

As part of this review, Otosigna may request additional documentation or information to further assess the validity of the claim. It’s important for policyholders to cooperate and provide any requested information promptly.

Claims that are incomplete or missing required documents may be returned for correction and resubmission, which can delay the claim approval process (Military OneSource).

The claim approval process for Otosigna follows specific regulations and guidelines outlined in the Joint Federal Travel Regulation (JFTR) (Military OneSource) and implements technology to significantly reduce errors, leading to more accurate and consistent decisions (Fizara).

Receiving Compensation or Denial

Once the review and investigation phase is completed, you will receive a decision on your claim. If approved, Otosigna will typically provide compensation for the damages or losses covered by your policy. The method of compensation may vary depending on the specific policy and the nature of the claim (Fizara).

The average processing time for claims is approximately 30 days, but it may take longer if additional information is required or if there is a high volume of claims being processed.

If your claim is denied, it’s important to understand the reasons for the denial and what steps you can take to appeal the decision. Check out our guide on insurance dispute resolution in Allentown for more information on how to handle claim denials.

Remember, the claim approval process is a key component of your Otosigna auto insurance in Allentown. Understanding what happens after filing a claim can help make the experience less stressful and more successful. For more details on Otosigna’s claim approval process, visit our guide on how to claim auto insurance in Allentown 2024.

Tips for a Successful Claim Approval

Navigating through the claim approval process of Otosigna can be a daunting task. However, understanding the intricacies of the process and adopting certain strategies can make it significantly smoother. This section will highlight some important tips to ensure a successful claim approval with Otosigna.

Communicating Effectively with Insurer

The first step towards a successful claim approval involves effective communication with your insurer. This involves promptly reporting the incident, providing accurate and complete information, understanding your policy, and regularly following up on your claim.

Missteps such as not reporting the incident immediately or providing incomplete or inaccurate information can potentially hinder the approval process.

Effective communication also involves understanding the specifics of your policy. This includes being aware of the policy’s deductible, which is the amount you need to pay before your insurance kicks in, and coverage limits, which is the maximum amount your insurance will pay for a claim.

Utilize the available resources from Otosigna, such as their online claim portal or mobile app, to facilitate your communication process.

Keeping Detailed Records of Expenses

Another crucial step in the claim approval process involves keeping detailed records of all expenses related to the claim. This includes all repair costs, medical expenses, and any other out-of-pocket expenses you might incur due to the incident.

Make sure to get an auto repair estimate from authorized repair shops and keep all receipts of the expenses. This detailed documentation will be extremely helpful when you are submitting your claim to Otosigna.

Remember, claims can sometimes take time to process, and you may be required to provide additional information or documentation during the process. Keeping detailed records will not only expedite the process but also ensure that you receive the rightful compensation you are entitled to.

By following these tips and understanding Otosigna’s claim approval process, you can navigate through the claim process with confidence. Remember, when in doubt, don’t hesitate to seek legal advice or reach out to Otosigna’s customer service for any clarifications.

Conclusion

Hope this simple guide on Otosigna Claim Approval Process helped you. It focuses on the key steps: documenting the incident, contacting the insurance company, and following their process for claim approval. The article emphasizes the importance of quick action, keeping good records, and clear communication. This makes the process of claiming insurance more straightforward. For more details, you can check the original source here.