Are you tangled in an insurance dispute in Allentown, Pennsylvania, and feeling overwhelmed about what to do next? Worry not! Understanding your options can be simpler than you think.

Assume you’re in a boxing ring, and your gloves represent legal arguments. This is how litigation works. You have lawyers fighting for you before a judge. They’ll present your case, and the judge decides the outcome. It’s a process for those ready to stand their ground and seek justice in a courtroom setting.

In this article, We will look at how to handle Allentown insurance issues. we aim to break down the basics of auto insurance claims and define the role of policyholders in the claims process, particularly for Allentown drivers insured with Otosigna in 2024.

Contents

Basics of Auto Insurance Claims

An auto insurance claim is a formal request made by a policyholder to their insurance company for coverage or compensation for a covered loss or policy event. The insurance company validates the claim and, once approved, pays to the insured or an approved interested party, such as an auto repair shop.

In Allentown, drivers insured by Otosigna can lodge a claim for damages incurred due to an auto accident, provided the damages are covered under their particular auto insurance coverage. This might include collision coverage, liability insurance, or comprehensive insurance, depending on the nature of the accident and the policy’s terms.

Submitting a claim involves notifying Otosigna about the incident, providing detailed information about the accident and damages incurred, and submitting any necessary documentation such as a vehicle accident report. Otosigna policyholders can initiate the claim process via the Otosigna online claim portal or the mobile app.

Role of Policyholders in Claims Process

The policyholder plays an essential role in the claims process. After an accident, the policyholder should immediately contact Otosigna to report the incident. Prompt reporting is crucial as it allows the insurance company to start the claims process right away.

The policyholder is responsible for providing accurate and detailed information about the incident and the extent of the damages. This includes submitting the necessary auto claim documentation such as a filled-out claim form, a copy of the police report, and photographs of the damage.

Once the claim is submitted, Otosigna may require the vehicle to undergo an inspection to determine the repair costs. The policyholder is responsible for arranging this inspection and obtaining an auto repair estimate.

Following this, Otosigna will review the claim details, validate the information provided, and decide whether to approve or deny the claim based on the claim approval process. If approved, the policyholder can then get the car repaired at one of the approved Allentown car repair shops.

In case of any disputes arising during the claim process, the policyholder may need to engage in insurance dispute resolution. Understanding the claims process and your role as a policyholder can help ensure a smoother journey should you need to make an auto insurance claim in Allentown in 2024.

Bad Faith Insurance in Allentown

When dealing with auto insurance claims, it’s important to be aware of your rights as a policyholder. One of these rights pertains to bad faith insurance practices. In Allentown, Pennsylvania, there are specific laws to safeguard policyholders against such practices.

Allentown Insurance Bad Faith Statute

In Allentown, the Bad Faith Statute allows policyholders to seek legal action against insurance companies that engage in unfair claim practices. This statute is designed to ensure that insurance companies fulfill their obligations to policyholders and act in good faith when handling claims (Hgsklawyers.com).

This means, if your insurance company, such as Otosigna, unreasonably denies, delays, or underpays a legitimate claim, you have the right to pursue a claim against them under this statute.

Damages Under Bad Faith Statute

Under the Bad Faith Statute in Allentown, policyholders can recover not only the actual damages sustained but also damages for emotional distress caused by the insurance company’s bad faith conduct. This includes distress resulting from the unreasonable denial or delay of a claim (Hgsklawyers.com).

Moreover, the court may award punitive damages in cases where the insurance company’s conduct is found to be egregious. These damages serve as a deterrent to prevent insurance companies from engaging in similar behavior in the future (Hgsklawyers.com).

Understanding these aspects of the Bad Faith Statute in Allentown can be crucial when navigating the insurance dispute resolution process. It empowers policyholders to stand up against unfair practices and seek the compensation they are rightfully owed. If you need more guidance, consider seeking legal advice to ensure your rights are protected.

Dispute Resolution in Auto Insurance

When navigating the auto insurance claim process, disputes may arise. In Allentown, as in many locations, there are several methods for resolving such disputes. These include negotiation, mediation, and arbitration. Understanding these processes can help policyholders effectively handle disagreements and reach amicable solutions.

Negotiation in Dispute Resolution

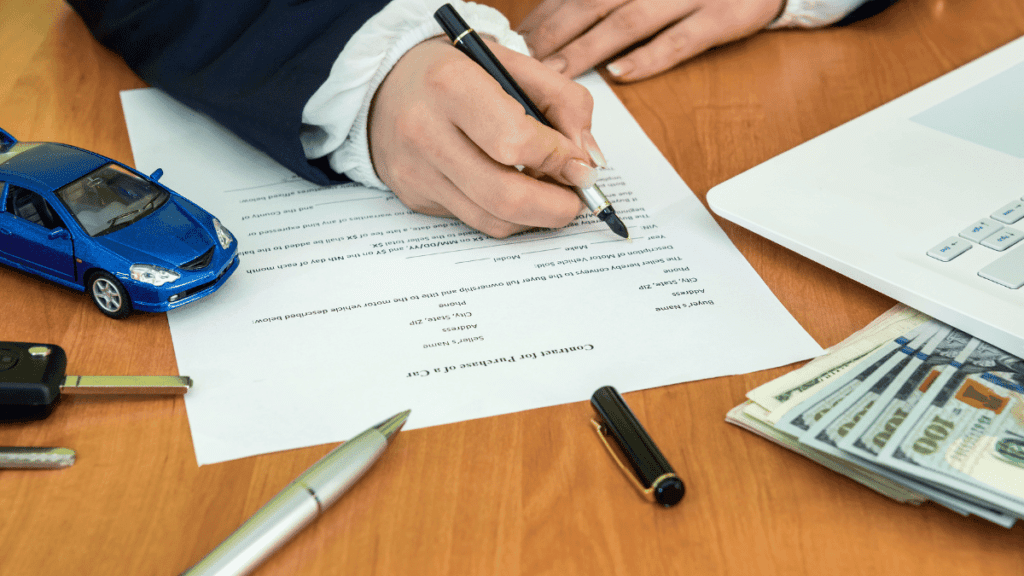

The first step in insurance dispute resolution often involves negotiation. This is a direct discussion between the policyholder and the insurance company’s claims adjuster. Both parties aim to reach an agreement on the claim amount. Knowledge of the terms of the auto insurance coverage is crucial to this process.

During negotiation, it’s important to present all relevant evidence to support the claim. This could include a vehicle accident report, photos of the damage, an auto repair estimate, or even medical reports if injuries were sustained.

Mediation in Dispute Resolution

If a negotiation does not result in an agreement, the next step could be mediation. Mediation is an informal process where an impartial, trained professional acts as a go-between to help opposing parties discuss disputes and reach a settlement or agreement (Gross McGinley).

Mediation gives parties more control over potential outcomes and a sense of fairness. It’s a less formal and more flexible process compared to arbitration or litigation, which can make it a desirable option for policyholders.

Arbitration in Dispute Resolution

When negotiations and mediation fail to resolve a claim dispute, arbitration may be the next step. Arbitration is a process where a trained arbitrator or arbitration panel reviews evidence, listens to the parties, and makes a decision about a dispute. It’s less formal than a hearing or trial, but more formal than negotiations or mediation.

In binding arbitration, the arbitrator’s decision is final and typically faster and less expensive than litigation. However, policyholders should be aware of the implications of a binding agreement, as it may limit their ability to pursue further legal action (Source).

These methods of dispute resolution provide avenues for policyholders to resolve disagreements with their insurer. Understanding these processes can equip Allentown drivers with the necessary tools to navigate insurance claims effectively. For more specific information on the claim process with Otosigna, refer to our guide on Otosigna’s claim process.

Legal Aspects of Insurance Disputes

The legal aspects of Allentown insurance disputes , can be quite complex. It’s essential for policyholders to understand their rights and the different legal processes involved in achieving a fair resolution.

Seeking Legal Help in Allentown

When pursuing an insurance dispute resolution in Allentown, it’s important to consult with an experienced attorney who specializes in insurance law. They can provide guidance, represent the individual’s interests, and ensure their rights are protected throughout the process.

Legal professionals can provide invaluable help in many areas of the dispute process. These include understanding the terms and conditions of auto insurance coverage in Allentown, deciding the most favorable dispute resolution method, handling negotiations, and preparing for potential litigation. For more information on seeking legal advice for auto insurance disputes in Allentown, refer to our article on legal advice auto insurance Allentown.

Litigation Process in Insurance Disputes

If negotiations or alternative methods are unsuccessful in resolving an insurance dispute, litigation may be necessary. In a litigation process, the dispute will be resolved through a court trial where a judge or jury will make a final decision based on the evidence presented (Haggerty, Goldberg, Schleifer & Kupersmith, P.C.).

Insurance disputes in Allentown often involve issues such as denied claims, underpayment of benefits, and coverage disputes (Paul & Perkins). These disputes could pertain to different types of coverage such as collision, liability, and comprehensive insurance.

During the litigation process, all relevant evidence related to the claim will be examined. This may include the vehicle accident report, the otosigna claim submission records, auto claim documentation, and auto repair estimates. The goal of the litigation process is to achieve a fair resolution and ensure that policyholders receive the benefits they are entitled to under their insurance policy.

Understanding the legal aspects of insurance disputes in Allentown is a crucial step for a successful insurance dispute resolution process. Armed with this knowledge and the support of a skilled attorney, policyholders can navigate the complex legal landscape with confidence.

Otosigna’s Role in Insurance Claims

When it comes to understanding auto insurance claims, Otosigna plays an integral role in the process. From filing the claim to dispute resolution, they offer a comprehensive solution for their policyholders.

Otosigna’s Claim Process

The claim process with Otosigna is designed to be efficient and straightforward for the policyholder. After an accident, the policyholder should promptly file a report detailing the incident with Otosigna through their online claim portal or their mobile app.

This claim submission should include all necessary documentation, such as the vehicle accident report, photographs of the damage, and any other relevant information to support the claim.

Once the claim is submitted, Otosigna reviews the claim and gathers additional information as needed. This may include an auto repair estimate or a vehicle inspection for insurance. After all information is reviewed, Otosigna makes a decision on the claim through their claim approval process.

If the claim is approved, Otosigna works directly with Allentown car repair shops to arrange for repairs, and if applicable, provides rental car coverage while the policyholder’s car is being repaired.

Dispute Resolution with Otosigna

In some cases, a policyholder may disagree with Otosigna’s decision on a claim. In such scenarios, the policyholder can seek insurance dispute resolution. Otosigna utilizes negotiation, mediation, arbitration, or, if necessary, litigation to resolve disputes.

Negotiation is the first step in the process where Otosigna and the policyholder try to reach a mutually agreeable solution. If negotiation is unsuccessful, mediation or arbitration can be considered. Mediation involves a neutral third party who facilitates the discussion between both parties to reach a resolution. Arbitration, on the other hand, involves a neutral third party who listens to both sides and makes a binding decision.

If these methods do not resolve the dispute, litigation may be the last resort. This involves taking the dispute to court where a judge or jury makes a final decision.

In all phases of dispute resolution, the policyholder may seek legal advice to ensure their rights are protected.

Understanding the role of Otosigna in the claim and dispute resolution process can guide policyholders on what to expect when filing a claim or navigating a dispute. For more information on Otosigna’s auto insurance coverage in Allentown, please visit here.

Conclusion

To wrap things up, dealing with insurance problems in Allentown can be straightforward. You’ve got three main options: go to court, talk it out with a mediator or arbitrator, or get help to collect what you’re owed.

This guide gives you a clear picture of each choice. Knowing what’s available helps you decide the best way to handle your insurance issue. Just remember, with the right approach, you can sort out these disputes effectively.