When you make a car insurance claim, an important part of the auto insurance claims process. This inspection is how insurance companies assess and verify the damage to your vehicle before they decide on your claim.

Why is this needed? It helps the insurance company make decisions like whether to approve your claim and how much your insurance should cost. Sometimes, state laws also require a car to be inspected before getting insured.

In this article, We will explain why these inspections are important for both the insurance company and the policyholder, and how they influence the outcome of insurance claims.

Contents

Importance of Vehicle Inspection

In the context of auto insurance, a vehicle inspection is a crucial step that can impact both the claim process and the policyholder’s coverage. It’s especially important for Allentown drivers with Otosigna auto insurance, as an understanding of the process and its impact can help them navigate their insurance claims in 2024 more effectively.

Role in Auto Insurance Claims

The vehicle inspection plays a significant role in insurance claims. Some insurance companies require vehicle inspections before providing coverage, while others do not (Compare.com). When filing a claim with Otosigna, for instance, having a recent vehicle inspection report can simplify and expedite the claim submission process.

The inspection report serves as an official record of the vehicle’s condition prior to the incident. This data is critical in assessing the validity of the claim, determining the extent of damage caused by the incident, and estimating the cost of repairs.

In case of disputes during the claim approval process, the inspection report can provide the necessary evidence to resolve the issue efficiently.

Safety and Value Assessment

A vehicle inspection for insurance purposes serves a dual role: assessing the safety of the vehicle and evaluating its value.

The safety assessment involves checking various components of the vehicle, including the body, mechanical systems, tires, brakes, lights, and other elements. This evaluation ensures that the vehicle is in safe operating condition, meeting the statutory safety standards.

The value assessment, on the other hand, helps insurers determine the market value of the vehicle. This information is crucial in calculating the appropriate premium for the auto insurance coverage and determining the payout in case of a total loss claim.

Vehicle inspections for insurance are typically required for used cars, older vehicles, high-performance vehicles, and vehicles with salvage titles. These inspections help insurers assess any pre-existing damage, which could influence claim decisions and premium calculations.

In conclusion, a thorough understanding of the importance and role of vehicle inspection in insurance claims can empower Otosigna policyholders to better manage their auto insurance in Allentown, making the claim process more transparent and efficient.

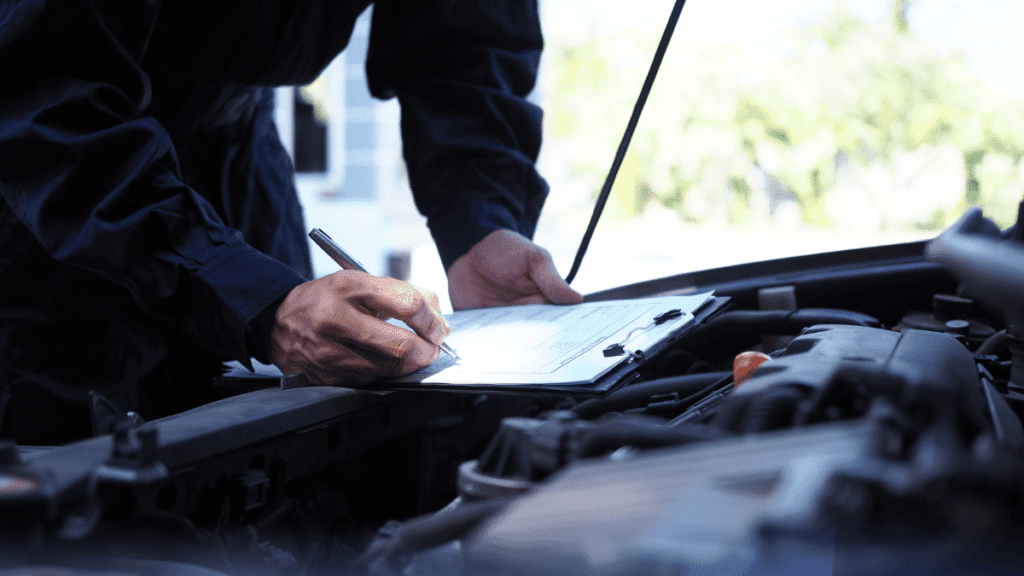

Understanding the Inspection Process

The process of vehicle inspection for insurance is an essential step in making an auto insurance claim. It involves a certified inspector examining the car’s interior, exterior, and mechanical components. This inspection can also include a test drive to check the vehicle’s performance. Here’s a breakdown of what to expect during the inspection process.

External Inspection

The external inspection is a thorough check of the vehicle’s outer elements. This typically includes assessing the condition of lights and reflectors, windshield, wipers, mirrors, and any visible body damage. This step helps identify any pre-existing damage that might impact the claim or the premium impact after claim otosigna.

Also, any signs of recent repair or replacement parts may warrant further investigation. Remember, honesty about the car’s state and its history of accidents or damage can expedite the claim approval process otosigna.

Internal Inspection

The internal inspection involves checking the condition of the car’s interior components. This often includes assessing the condition of seatbelts, steering wheel and column, and airbags. Special attention is given to any elements that could influence the safety of the vehicle and its occupants.

The inspector might also check the odometer to verify the vehicle’s mileage. A significantly high or low mileage can affect the car’s value and, consequently, the insurance claim.

Mechanical Inspection

Lastly, the mechanical inspection is an in-depth examination of the vehicle’s mechanical components. This typically includes checking the engine, brakes, fluid leaks, exhaust and emissions, transmission, suspension, axles and frame, and tires.

The purpose of this inspection is to identify any issues that could impact the vehicle’s performance or safety. Any significant mechanical problems could affect the insurability of the vehicle and, therefore, the insurance claim.

In conclusion, understanding the inspection process can help Allentown drivers, especially those with Otosigna insurance, better prepare for their vehicle inspection for insurance. This knowledge can contribute to a smoother claim process, potentially leading to a quick and fair settlement.

For more information on how to claim auto insurance in Allentown, refer to our comprehensive guide on how to claim auto insurance in Allentown 2024 Otosigna.

Preparing for Inspection

Before filing an Otosigna auto insurance claim in Allentown, it’s crucial to understand what preparing for a vehicle inspection entails. This process involves gathering necessary documents and selecting an appropriate inspection location.

Necessary Documents

To proceed with a vehicle inspection for insurance, you will need several required documents. These typically include the vehicle’s title, an inspection form, proof of insurance, and your driver’s license. It’s important to keep these documents readily available for the inspection process.

Here’s a checklist of necessary documents:

- Vehicle Title

- Inspection Form

- Proof of Insurance

- Driver’s License

Remember, the purpose of this inspection is to assess the condition and value of the vehicle and identify any pre-existing damage. If you recently had an accident, your vehicle accident report could also be of importance during this process. The inspection results will be a critical part of your Otosigna claim submission.

Choosing an Inspection Location

Approved vehicle inspection locations are typically auto repair shops and gas stations. It is advisable to choose a location that is convenient for you and familiar with the inspection requirements of Otosigna. Some insurance companies might have specific approved locations, so it’s always important to verify this with your insurance provider.

Remember, the goal of the vehicle inspection is to ensure your car is in proper condition. This assessment is crucial for determining the cost of your auto insurance coverage and the extent of your coverage, whether it’s collision, liability, or comprehensive insurance.

By adequately preparing for the inspection, you can ensure a smooth and efficient process, making your car insurance claim in Allentown 2024 a hassle-free experience.

Potential Outcomes of Inspection

The outcome of a vehicle inspection can significantly impact an auto insurance claim, particularly with Otosigna in Allentown. The inspection findings may influence the premiums and even determine whether the coverage is granted or denied.

Possible Impact on Premiums

The outcome of a vehicle inspection can directly affect the premiums of your auto insurance policy. Inspections help insurers determine the condition and value of a vehicle, as well as assess any pre-existing damage.

If the inspection uncovers issues, it may lead to higher insurance premiums (Car and Driver). For more information on how claims can affect your premiums with Otosigna, visit our page on premium impact after claim otosigna.

Inspections are typically required for new policies, policy renewals, and when adding a new vehicle to an existing policy (Allstate). Especially in cases of older cars or vehicles with salvage titles, inspections can help reduce fraud and ensure that the insurance adequately covers potential issues.

Case of Failed Inspection

If a vehicle fails the inspection or has significant pre-existing damage, it may impact the insurance coverage and cost. In such cases, insurance companies may require repairs to be made or may decline coverage altogether for the vehicle.

The specific inspection requirements and criteria may vary depending on the insurance company and state regulations. For instance, Otosigna may have its own set of requirements for vehicle inspections, which you can learn more about on our otosigna auto insurance allentown page.

In the unfortunate event of a failed inspection, it’s crucial to understand your options, which may include dispute resolution or seeking legal advice. For more information, you can visit our pages on insurance dispute resolution allentown and legal advice auto insurance allentown.

Technological Advances in Vehicle Inspection

The landscape of vehicle inspection for insurance claims has significantly evolved with the advent of advanced technologies. These innovations have made the process more efficient and reliable, offering an objective framework that reduces human error.

Use of AI in Inspection

Artificial Intelligence (AI) is at the forefront of these technological advancements. AI-based solutions are being increasingly utilized for vehicle inspections due to their ability to detect and predict internal damages accurately and reliably.

Skilled technicians or AI-based inspection solutions can identify hidden damages that are not evident but can affect the vehicle’s reliability. This is of particular importance when processing an Otosigna auto insurance claim following a collision or accident.

The comprehensive assessment provided by AI technology ensures that all potential issues are covered, reducing fraudulent claims and benefiting both the insurance provider and the policyholder.

Benefits of Technology in Inspection

The integration of technology into the inspection process has several key benefits. Firstly, AI technology provides an objective and accurate assessment of a vehicle’s condition and value (Premier Risk, LLC). This can be invaluable when determining the appropriate auto insurance coverage and premiums.

Furthermore, the efficiency of AI-driven inspections can expedite the claim process, allowing for quicker resolutions and payouts. This is particularly useful when accessing the Otosigna online claim portal or using the mobile app for insurance claims.

Incorporating AI technology into vehicle inspections is a promising development in the auto insurance industry. By providing more accurate, efficient, and objective inspections, policyholders can have more confidence in the claim process and outcomes.

As this technology continues to evolve, it is expected to further streamline the claim process and improve customer satisfaction. It’s one of the many ways Otosigna is committed to serving its Allentown customers in 2024 and beyond.

Legal and Regulatory Aspects

Understanding the legal and regulatory landscape surrounding vehicle inspections for insurance claims is crucial for Allentown drivers, especially those insured with Otosigna.

State Laws on Vehicle Inspection

Several U.S. states mandate vehicle inspections before a vehicle can be registered through the Department of Motor Vehicles (DMV).

The primary objective of these inspections is to ascertain if the vehicle is safe to operate and does not pose a threat to other road users. However, some states, including Florida, Michigan, South Carolina, Wyoming, and Montana, do not necessitate vehicle inspections.

As a driver, it is essential to familiarize yourself with the specific laws in your state regarding vehicle inspections. If you live in a state that requires inspections, ensure your vehicle passes the state-mandated inspection to avoid potential issues with registering your vehicle or filing an insurance claim.

Insurance Company Policies

In addition to state laws, insurance providers may have their own policies related to vehicle inspections. For instance, some insurers necessitate vehicle inspections as part of the insurance application process.

The purpose of these inspections is to evaluate the condition and value of the vehicle and identify any pre-existing damage (Source).

Otosigna, for example, may require vehicle inspections under certain circumstances. These might include insuring a high-value vehicle, a vintage or classic car, or a vehicle with a salvaged or rebuilt title.

If a vehicle fails the inspection or has substantial pre-existing damage, it could impact the insurance coverage and cost. In such cases, Otosigna might require repairs to be made or may decline coverage altogether for the vehicle (Source).

Furthermore, Otosigna policyholders should be aware that vehicle inspection for insurance is becoming increasingly common, with more insurance companies requiring it as part of the insurance application process.

For more specific information on Otosigna’s vehicle inspection requirements and policies, please refer to the otosigna auto insurance allentown page.

Additionally, for advice on legal aspects of auto insurance in Allentown, consider checking out our legal advice auto insurance allentown page.

Conclusion

To conclude this article, we discussed on the importance of car insurance inspections when making a claim. We explained how these inspections help decide on claims and affect insurance costs. We also talked about self-inspections, a newer method that’s quicker and easier for policyholders. Understanding these inspections can make dealing with car insurance claims much easier.